CIM First Quarter Market Commentary & Outlook

Key Considerations:

- Not nearly enough attention has been paid to broader economic history, especially as it relates to the events that occurred in the years following the Volcker, Fed hiking cycle, including the seven hiking cycles that came later.

- If we had a nickel for every time an investor shared with us their deep and justified regret for not having purchased longer-term bonds during the 80’s, we would all be very rich.

- Investors should be comforted by the knowledge that 10-year Treasury bond yields have already fallen by almost 1.00%, or 100 basis points, since they peaked in October of 2022.

- State and local governments have the largest general fund and rainy-day fund balances they have ever had in history.

- We recommend investors extend out of short-term cash and short tax-free bonds, given the likelihood of further underperformance.

- We encourage investors not to be distracted by what appear to be high, but are likely fleeting, short-term cash yields.

- Take advantage of this window of opportunity to lock in higher yields, through longer duration bonds.

Andrew Clinton

CEO

Has a Golden Age of Fixed Income Finally Arrived

In volatile environments such as these, we often turn to the sage advice of those who came before us. Their wise and measured guidance has endured over time, distilling experiences of the past, while providing lessons and guidance for the future. We are reminded of the importance of critical thinking in times of market uncertainty and remaining focused during upheaval caused by challenging economic convulsions. The famous quote by Mark Twain, who said, “History never repeats itself, but it does often rhyme”, comes to mind, yet another more salient quote from Warren Buffet is even more prescient.

“What we learn from history is people don’t learn from history.”

-Warren Buffett

Wall Street pundits have drawn numerous corollaries between the inflationary period of the 1980’s and today, yet, in our view, not nearly enough attention has been paid to broader economic history, especially as it relates to the events that occurred in the years following the Volcker, Fed hiking cycle, including the periods that followed the seven hiking cycles that came later. Therefore, it is essential to explore and understand what came “after”, in the hopes of avoiding the mistakes of the past, while taking advantage of the opportunities the current market environment presents.

The 1980’s

Students of the market may recall that the Federal Funds Rate reached a peak of 17% in March of 1980. The bear market in stocks began eight months later, in November of 1980, as the S&P proceeded to lose 27% over the 20-month period that followed. At that time, investors had the option to invest in cash and savings vehicles yielding +16%, or they could have invested in Ten Year Treasury bonds yielding just over 12%. We know from history that many investors chose to remain invested in cash and short-term instruments, rather than investing in longer-term bonds. With the benefit of hindsight, we also now know that many, if not all, investors who chose that path, regretted their decisions, as the value of the fixed cash flow of longer-term bonds lasted decades longer than the fleeting, higher yields of their cash positions. The rest, as they say, is history. Interest rates proceeded to fall dramatically over the next four decades, ushering in the age of secular stagflation and deflation, delivering very strong total returns to agile investors who correctly extended the durations of their fixed income portfolios and held on as rates cascaded downward.

If We Had a Nickel

If we had a nickel for every time an investor shared with us their deep and justified regret for not having purchased longer-term bonds during the 80’s, we would all be very rich. Even today, investors speak fondly of the “good ol’ days”, when one could achieve an attractive return investing in bonds. To this point, we are happy to share some very good news. The “good ol’ days of fixed income have returned. High-net-worth investors can now achieve equity-like returns, from the tax-free, cash flow that municipal bonds offer, and yet, municipal bonds carry much lower risk than equities. Longer intermediate and long-term municipal bonds are offering taxable-equivalent yields/returns over 7% and in some cases 8%, for those in the highest tax bracket. If rates continue to decline, the total return investors can achieve would be higher still. Given the probability that rates could fall considerably over the next 12-24 months, the upside potential for municipal bonds is the highest it has been since the Great Financial Crisis, in our view.

Worries About Higher Interest Rates

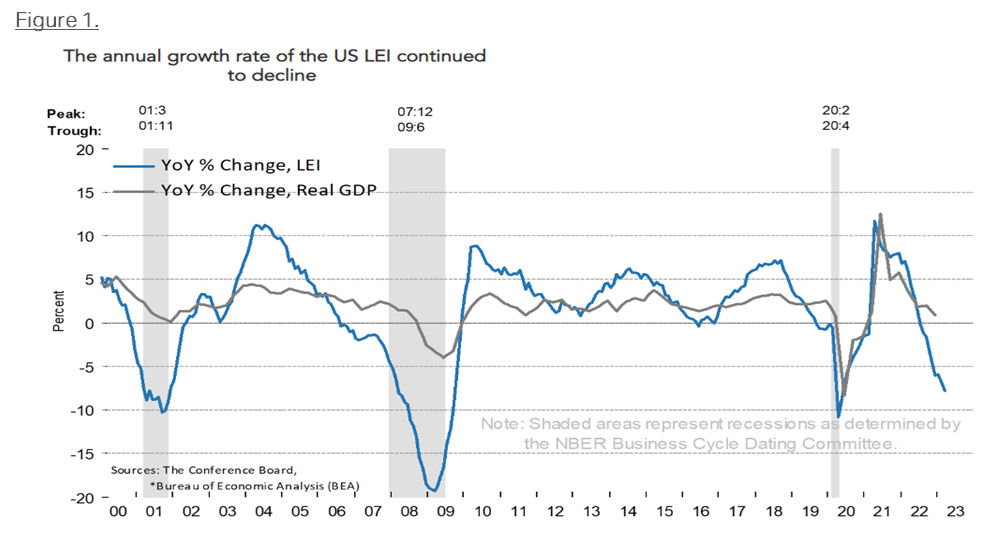

We continue to hear investors expressing concerns about the potential that interest rates could rise further from here. These concerns are understandable given that fixed income investors endured one of the worst bond market performances in over 40 years, during 2022. Having said that, investors should be comforted by the knowledge that 10-year Treasury bond yields have already fallen by almost 1.00%, or 100 basis points, since they peaked in October of 2022. This decline in rates was in response to the downward trend in inflation, which peaked in the summer of 2022, driven by the decline in prices of commodities, goods, and now even some areas of the service economy. Should declines in inflation continue unabated, interest rates are more likely to fall materially, going forward, rather than rise. When one considers the possibility and likelihood that a US recession takes hold in the coming months, we believe the worst fears of bond investors will continue to fade over time. It is also worth noting that the Federal Reserve is expected to raise rates for the last time in May, then pause further rate hikes. We know from history that, when the Fed pauses, they begin cutting interest rates roughly five months later, on average. While this time may be different in some respects, the data we are seeing, from the significant price declines of the commodities complex, weakening consumer spending, accelerating credit card balances, to rising delinquency rates, indicate to us that a material slowdown in US economic activity is occurring. It is also worth noting that we have now seen 12 consecutive months of declining Leading Economic Indicators (LEI)’s, see Figure 1. In every other instance, when this has occurred, a recession has also occurred, 100% of the time.

Muni Credit Outlook Remains Positive

The credit outlook for municipal bonds remains extremely constructive. Broadly speaking, state and local governments have the largest general fund and rainy-day fund balances they have ever had in history. We expect municipal credit quality to remain stable, even as the economy dips into, what may be, a prolonged economic recession. Considerable value could be lost if investors wait for certainty that the recession is upon us. Markets are anticipatory. By the time we know, with certainty, that the recession is here, interest rates will likely have already moved dramatically lower. When we also consider the possibility that the regional banking crisis we are currently experiencing may not be the last financial accident to occur, interest rates could fall much further than many are anticipating. The regional banking crisis is not an idiosyncratic event, in our view, however, we also do not believe it is an existential crisis for capitalism, as was the case during the Great Financial Crisis. We simply believe that this economy is unhealthy and the safety of high-quality bonds will reflect that reality quite soon. The Treasury curve inversion clearly indicates that over the next 12 to 24 months interest rates are likely to fall dramatically.

Short-Term Municipal Bonds are at Risk of Further Underperformance

Municipal bond investors must be careful as the municipal bond curve remains inverted inside of 10-year maturities, making short-term maturities particularly unattractive, in our view. We firmly believe the positively sloped nature of the municipal yield curve, between 2-year bonds and 30-year bonds, make longer duration bonds compelling. We are, therefore, encouraging investors to extend out of short-term cash and short tax-free bonds, given the risk of further underperformance relative to long duration bonds. For example, 15 year and 20-year munis have outperformed 3-year bonds by +3.25% and +5.76% respectively, over the past six months, according to Bloomberg.

“The lesson of history is that you do not get sustained economic recovery as long as the financial system is in crisis.”

– Ben Bernanke

What Have We Learned from the Past

The time for investors to add to their fixed income allocations has arrived, in our view. The safety and stability of strong underlying fixed income securities, together with consistent, attractive cash flow, should provide comfort to investors as we enter, what is expected to be, a very volatile period for markets over the next 12 -24 months. We encourage those who remain underweight fixed income to consider increasing their exposure to a neutral if not overweight position. In so doing, investors will, hopefully, avoid the mistakes investors made, in the 80’s, by those who stayed too long in cash vehicles and ultimately regretted it. We advise investors not to be distracted by what appear to be high, but are likely fleeting, short-term cash yields. Rather, we encourage investors to take advantage of this window of opportunity to lock in higher yields, through longer duration bonds, capturing attractive tax-free income while it persists. Of note, the International Monetary Fund’s (IMF)’s recently released research, concluding that the low-rate environment, that persisted prior to the pandemic, is likely to return over the next five years. This should provide further confidence to investors as the outlook for fixed income has not been this strong for a very long time.

Clinton Investment Management (CIM) News

We are pleased to announce that the CIM team continues to expand. Shivani Singh joined CIM in Q1 23 as Director of Credit Research. Shivani was Team Leader at S&P Global ratings where she spent 13 years covering not-for-profit higher education, charter schools, community colleges, and private K-12 schools. We are confident Shivani’s deep credit research experience and industry knowledge will further strengthen our team as well as the performance we deliver to our clients over time.

Please do not hesitate to contact us if you should have any questions regarding the content in this commentary or the municipal bond market more broadly.

Best regards,

Andrew Clinton CEO

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product,madereference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Clinton Investment Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. The PSN universes were created using the information collected through the PSN investment manager questionnaire and use only gross-of-fee returns. The PSN/Informa content is intended for use by qualified investment professionals.Please consult with an investment professional before making any investment using content or implied content from any investment manager. A copy of our current written disclosure statement discussing our advisory services and fees is available for reviewupon request.