CIM First Quarter Market Commentary & Outlook

Key Considerations:

- US GDP growth contracted by -1.40% in Q1.

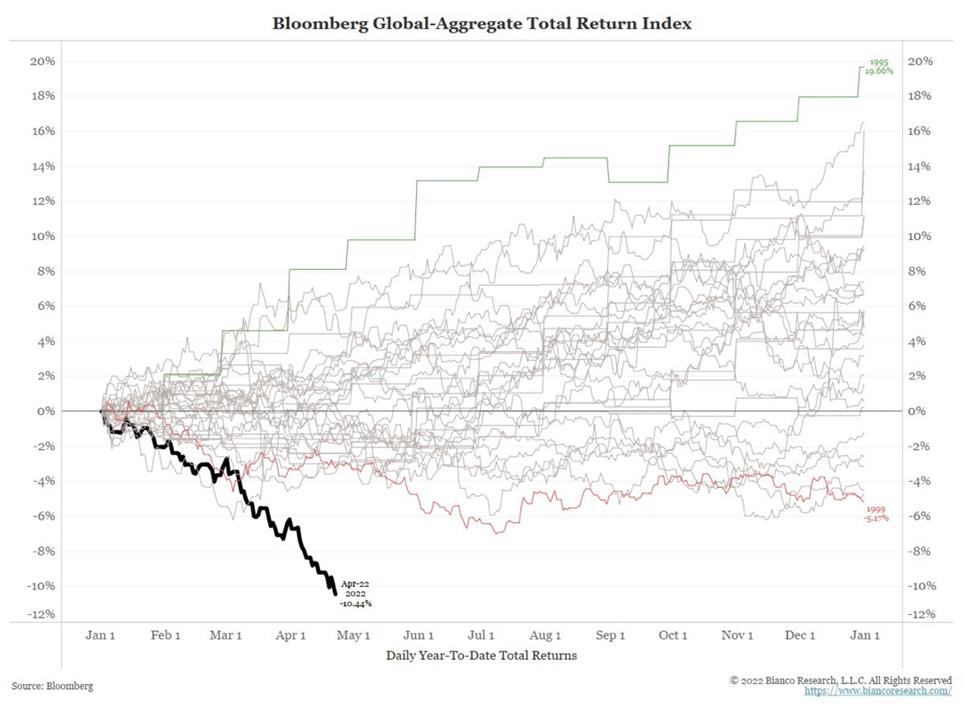

- Fixed income markets have experienced the worst start to a year, from a performance perspective, in forty years.

- Municipal bonds are now two to three standard deviations cheap relative to taxable bonds.

- Moody’s issued 817 upgrades for municipalities in 2021 compared to 307 down grades.

- Since 1927, the Fed has never reduced inflation by more than 2.9% without causing a recession.

Andrew Clinton

CEO

The first four months of 2022 have been the most tumultuous period for investors since the onset of the pandemic in March of 2020. For fixed income markets, it has been the worst start to a year, from a performance perspective, in forty years, see Figure below. Elevated inflationary pressures, resulting from extended COVID lockdowns and corresponding supply chain dislocations, together with tremendous fiscal stimulus, have taken center stage in terms of their contribution to inflation. The outbreak of war in Ukraine has further amplified pressure on energy and commodities prices. The Fed pivoted dramatically, in Q4 2021 from a position on the economy of watchful patience and a belief that inflation would prove transient, to its now, much more, hawkish view on inflation. The Fed is stridently messaging to markets its intent to forcefully use interest rate hikes to break the back of inflation. This shift in narrative has surprised markets and contributed to a dramatic rise in volatility and uncertainty, raising recession risks meaningfully. The impact of tightening financial conditions can be seen in the recent -1.4% contraction in Q1 US GDP growth. Some, in the investment community, have attributed this contraction to a one-off aberration, resulting from a surge in imports. We believe dismissing this important economic indicator is the equivalent of whistling past the graveyard.

While we see the surge in imports as an important indication that the supply chains are healing, a resulting surge in inventories is occurring at a moment when the economy and consumer spending is likely to slow materially. We firmly believe the trajectory of US economic growth is decidedly downward and should not be dismissed. As domestic economic growth continues to slow, we expect the slowdown in growth globally to further weigh on economic activity domestically. Stagflationary forces, including higher fuel prices and a corresponding reduction in spending and slowing growth have already begun to change consumer behavior and spending decisions, as can be seen in the 8% decline in real, inflation-adjusted, gasoline consumption in March. Consumers are clearly choosing to drive less due to high gas prices. If high gasoline prices persist, and we expect they will, it will likely further dampen economic activity more broadly. We also expect a further reduction in discretionary spending as the Fed tightens financial conditions. The equity market has begun to price in this new reality, as evidenced by the recent performance of many procyclical sectors within the S&P 500. Asset Management, Rails, Construction Materials, Media and Entertainment, Homebuilders, Home Furnishings, Retailing, Banks, and Consumer Electronics sectors are all down 28%, 13%, 19%, 31%, 40%, 20%, and 23% respectively year-to-date, while the Industrial Materials and Electrical Equipment sectors are down 20% and 18% respectively. Software is down 25% while telecom equipment is off by 19%. The equity market declines support the view that the Fed will be successful in destroying demand, together with wealth, resulting in lower inflation over time. Mortgage applications are now lower by over 50%, year-over-year, while refinancing activity has fallen by roughly 70% over the same period. This will have a material impact on housing price affordability and ultimately exert downward pressure on housing prices and sales volume. The probability of a Fed policy mistake has risen considerably. Bond Markets have now priced-in over 200 basis points of rate hikes, yet the Fed has only raised rates by 0.25% in March and 0.50% yesterday. We believe the Fed will ultimately tighten financial conditions too much, pushing the economy into a recession, as it has in almost every instance over the course of history. Since 1927, the Fed has never reduced inflation by more than 2.9% without causing a recession, according to Guggenheim research. It is also worth noting that the last time the Fed hiked rates into a slowing economy was 2018. The impact of the Fed actions resulted in a crash in equity markets in December of that year. The Fed was forced to rapidly reverse course soon thereafter. We believe the outcome will be similar in this instance, assuming the Fed implements the rate hikes the market is now expecting.

The municipal bond market has not been immune to the rise in interest rates year-to-date. Municipal bonds have endured the worst start to the year, in terms of performance, in recorded history. Municipal bond prices have declined across the entire maturity spectrum. The 5 year, 7 year, 10 year and 30 year, Bloomberg Barclays Municipal Bond indices, returned -5.10%, -5.70%, -6.23% and -8.65% respectively in Q1. It came as a painful surprise to more passive investors that high quality, short maturity bonds did not provide the protection they expected. As unsettling and unwelcome as this experience has been for municipal bond investors, moments such as these provide a lens through which we can focus on the primacy of deep underlying credit research. Identifying issuers with solid underlying fundamentals can provide investors with the confidence that is needed to ride out temporary periods of rising rates. The decline in municipal bond prices has been exacerbated by sixteen consecutive weeks of outflows from municipal bond mutual funds. The over $40 billion in outflows from bond funds has resulted in a temporary decline in market liquidity to due forced selling by mutual fund managers, causing yields to rise and spreads to widen. The current outflow cycle is now the fourth longest outflow cycle in the history of the municipal bond market and has caused municipal bonds to cheapen relative to other fixed income alternatives. Municipal bonds now offer tax-free yields that are the same or higher than taxable bonds. Stating it another way, municipal bonds are now two to three standard deviations cheap, relative to taxable bonds. We do not expect this relationship to be sustained. Nontaxable, crossover buyers are already finding the absolute level of municipal bond yields to be compelling and have begun buying, even though they may not fully benefit from their tax-exemption.

Investors can be comforted by the knowledge that the US economy is very late in the current business cycle. The Fed has already begun the tightening cycle and we believe it will not stop until it pushes the economy into recession. We also know that, during recessions, interest rates fall dramatically, thereby, restoring principal value that was lost due to price reductions that occurred when rates where rising. It is important to note that investors with a long-term, investment horizons who have additional liquidity to take advantage of the currently very attractive level tax-free yields, should do so in our view. Valuation is now a major source of support for the municipal bond market going forward.

Some good news in this environment is that the outlook for municipal credit quality continues to be the brightest it has been in over two decades. The combined benefits of over $500 billion in fiscal support, provided to municipalities from the American Rescue Plan, together with dramatically higher tax collections municipalities have enjoyed since the onset of the pandemic, have materially strengthened underlying municipal credit quality on a broad scale. Moody’s issued 817 upgrades for municipalities in 2021 compared to 307 down grades. Through February 2022, municipal bond defaults totaled just $360 million, or 0.10% of the over $4 trillion of municipal bonds outstanding. Despite the stable to improving credit outlook, lower investment grade, Baa/BBB rated bonds, have widen by over 50 basis points, reflecting the weaker demand environment created by mutual fund outflows. Given the inefficiencies this outflow cycle has created, we continue to believe the best opportunities exist in lower investment grade bonds, given that investors enjoy very attractive compensation in the form of higher yields, together with low credit risk. The 4% to 4.25% tax-free yields investors can now achieve in lower investment grade municipal bonds equate to over 7.2% on a taxable equivalent basis, for those in the highest tax-bracket. We believe these yields are extremely compelling when one considers that the expected return on risk asset allocations may be as low as 3% to 5% annually over the next 10 years, according to Vanguard.

As we look forward to the coming weeks and months, we fully expect the uncertainty and volatility that has plagued markets to persist, however it may also increase as tightening financial conditions exert further downward pressure on risk asset valuations. In the coming days we will also learn if the US economy has reached peak inflation, which is our base case. As such, we believe the Fed’s intentions of using interest rate hikes to destroy demand for goods and services will be successful. They have all the tools necessary to break the back of inflation. The challenge the Fed is faced with is the growing risk that their actions will push the US economy into recession sooner rather than later. The Q1 GDP contraction is the best illustration of the precarious path the Fed is now on. Slowing growth has clearly arrived at the same time that stagflationary forces are pushing the prices of everyday items, such as food, energy, and the cost of housing to unsustainable levels. Something is going to break. When it does, the US economy will be the lesser for it.

If you should have any questions regarding this commentary or the municipal bond market more broadly, please do not hesitate to contact us directly.

Best Regards,

Andrew Clinton

CEO

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product,madereference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Clinton Investment Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. The PSN universes were created using the information collected through the PSN investment manager questionnaire and use only gross-of-fee returns. The PSN/Informa content is intended for use by qualified investment professionals.Please consult with an investment professional before making any investment using content or implied content from any investment manager. A copy of our current written disclosure statement discussing our advisory services and fees is available for reviewupon request.