CIM Fourth Quarter Market Commentary & Outlook

Key Considerations:

- For the year, municipal bonds returned -8.5% while Treasury bonds returned -12.5%, corporate bonds returned -15.8%, the S&P 500 returned -19.5%, and the NASDAQ returned -33.2%

- As stated in our CIM Q4 21 Market Commentary and Outlook, we shared the expectation that we were likely to see a material slowdown in US economic growth in 2022

- We can now see that inflation peaked in June of 2022, very close to the timing we anticipated.

- Forced liquidations caused the municipal bond market to dislocate from the Treasury market while the Treasury curve inverted, the muni curve remained steeply sloped.

- The Fed’s commitment to the notion of deliberately pushing the US economy into recession was also unexpected in 2022 as it was inconsistent with decades of prior central bank policy.

- The broader investment community is now beginning to coalesce around the outlook for recession in 2023.

- 2023 should be the year of the bond investor in our view.

- It is important to note that there is still time for investors to take advantage of the current municipal bond market, yield curve dislocation

Andrew Clinton

CEO

It may be stating the obvious to suggest that most investors were grateful to say goodbye to 2022, as we experienced one of the worst years of financial market performance in history. A meaningful slowdown in US economic growth, together with the Fed’s aggressive tightening of financial conditions, via multiple Fed Fund rate hikes, took many by surprise in 2022. This resulted in a surge in uncertainty surrounding the future direction of interest rates, corporate earnings, US payrolls, and housing prices, in particular. A corresponding decline in almost all financial asset values ensued. While 2022 was a challenging year, by almost any measure, municipal bonds continued to demonstrate why they are perceived as one of the safest asset classes one can invest in. For the year, municipal bonds returned -8.5% while Treasury bonds returned -12.5%, corporate bonds returned -15.8%, the S&P 500 returned -19.5%, and the NASDAQ returned -33.2%, according to Bloomberg. We are sensitive to the notion that the smaller negative absolute returns of munis may be little consolation for investors, even if munis did outperform almost every other asset class, as this was the worst muni bond market performance in over 40 years. We are, however, reminded that losing less, when other assets classes lose more, is an essential ingredient when preserving and building wealth over time. We also are reminded that a challenging year, like 2022, provides an opportunity to assess not only what went wrong, but also what went right. High on the list of what Clinton Investment Management (CIM) got right, as stated in our CIM Q4 21 Market Commentary and Outlook, was the expectation we shared that we were likely to see a material slowdown in US economic growth in 2022, as well as an aggressive path of Fed tightening. Throughout 2022, we also expressed concerns relating to risk asset valuations, in response to the corresponding tightening of financial conditions, which we expected to weaken the US consumer.

Forced liquidations caused the municipal bond market to dislocate from the Treasury market as the Treasury curve inverted, the muni curve remained steeply sloped.

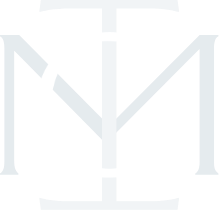

The explosion in revolving credit card debt, in the last year, illustrates this point clearly, see Figure 1. If the consumer was as “resilient” as many of the financial pundits would have us believe, we would not see consumers being forced to use high interest credit cards to support their ongoing spending. We also firmly believed that tighter monetary policy would translate to weaker corporate profitability, resulting in falling risk asset valuations, both of which came to pass. We did not, however, anticipate the onset of war in Ukraine or the corresponding

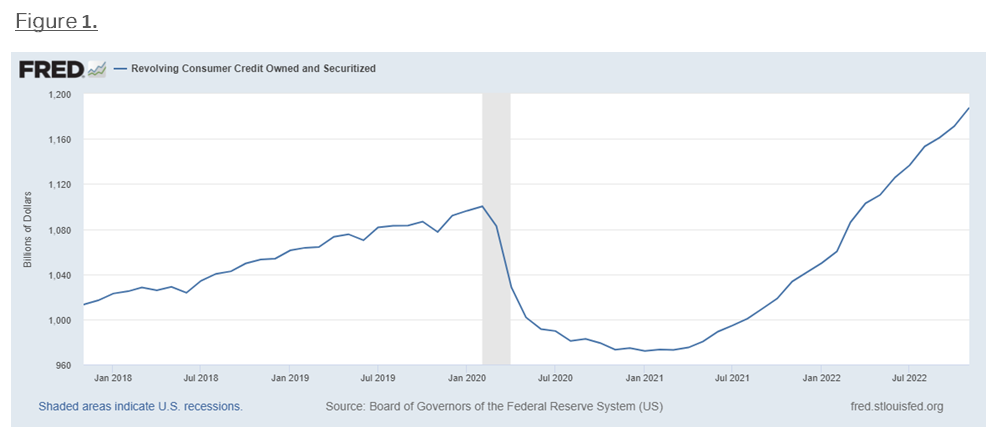

upward pressure the war exerted, albeit temporarily, on commodity prices. Higher commodity prices, oil in particular, caused headline inflation to persist for a couple of months longer than we anticipated. We can now see that inflation peaked in June of 2022, very close to the timing we anticipated. Inflation has been falling ever since, see Figure 2.

It is also worth noting that Manufacturing and Non- Manufacturing, Purchasing Managers indices (PMI) are now contracting, indicating that the direction of US economic activity continues to be downward and may also indicate that the US economy is already in recession.

While the yields on short-term Treasury bonds rose much more than long-term Treasury bond yields, the indiscriminate selling of retail municipal bond funds, by shareholders, resulted in the highest year of mutual fund outflows in the history of the municipal bond market. Over $115 billion flowed out of open-end municipal bond funds in 2022. Ongoing outflows added to the selling pressure, forcing yields on the long-end of the muni market higher, due to insufficient demand to absorb the supply. These forced liquidations caused the municipal bond market to dislocate from the Treasury market. As the Treasury curve inverted, the muni curve remained steeply sloped. Our recommendation to investors, in response to this dislocation, was to act expeditiously, looking to underweight highly rated municipal bonds, due in 1-5 years. We believe substantial risk of underperformance persists in these maturities, given the extremely positive slope of the municipal bond curve as well as very low absolute and relative yields of short-term muni bonds. In recent weeks we have begun to see the muni curve normalize as short maturities have underperformed longer duration bonds by over +5.00% or 500 basis points, just since Nov 1. The muni curve is now inverted between 1 and 12 years, a rare phenomenon.

The Fed’s apparent commitment to deliberately pushing the US economy into recession was also unexpected in 2022, as this posture is inconsistent with decades of prior central bank policy. Economic recessions are outcomes that the Federal Reserve has sought to avoid in the past. This time, the fastest Fed hiking cycle in history clearly illustrates to us that the Fed perceives a recession as a tool to constrain inflation. Recession will likely exert downward pressure on wage inflation, resulting in moderating inflationary pressures and inflation expectations. The Fed has stated its full commitment to returning inflation to its 2% target and we believe them. We also believe the Fed has already hiked interest rates too far, tightening monetary conditions too much, which will likely result in a meaningful recession in 2023. While the economy has begun to slow, the Fed has assured us that it is going to rase interest rates higher still. It’s worth noting that almost the entirety of the previous interest hikes, that took place in 2022, have yet to be felt by the US economy. Historically, it takes roughly four to six quarters for rate hikes to begin to impact the economy. When one considers that the Fed only just began hiking rates three quarters ago, the full force of these rate hikes is indeed, yet to come, in our view.

The broader investment community is, just now, beginning to coalesce around our outlook. Therefore, looking out over the next 12 months, we expect the environment for fixed income to be quite good. For example, Bank of America and Morgan Stanley’s research departments have both indicated that they believe the performance of municipal bonds could be anywhere between +8% to over +11% respectively in 2023. Our view is that those estimates are likely to be conservative. Municipal bond investors may be surprised by the level of positive absolute returns they achieve in their municipal bond holdings this year. Investors are well compensated for low credit risk in munis and limited likelihood that rates will rise further. In addition, the Fed has indicated that it is approaching the end of its tightening cycle. When we considers that municipal bond investors can achieve tax-free yields over 4.00%, equating to an equity-like return of roughly 7% on a taxable basis through income alone, for those in the highest tax bracket, the case for munis becomes even more compelling. Any further decline in interest rates from here will add meaningfully to an investor’s principal return as well. We are positioning our client portfolios accordingly given this opportunity as we believe 2023 should be the year of the bond investor.

It is important to note that there is still time for investors to take advantage of the current municipal bond market, yield curve dislocation. Active tax loss harvesting of existing mutual fund and individual bond positions not only can deliver meaningful tax alpha, but it provides an opportunity to better positions one’s bond portfolio, in a highly tax efficient manner, to take advantage of the changes in the economic outlook and the bond market more broadly. CIM was extremely active, throughout 2022, harvesting losses, delivering significant tax alpha to our clients. In addition, the importance of active and ongoing credit oversight cannot be overstated, as we continue to invest in stable to improving underlying credits, even as the economic slowdown gathers momentum.

When a hurricane is approaching, individuals are encouraged to prepare, securing their assets and taking cover. Continuing with that metaphor, municipal bonds are much like the financial plywood that helps investors protect their financial lives, in the midst of an economic storm, protecting investors from significant loss as they await the return of clearer skies.

We have begun to move up in credit quality and we are extending duration to increase yield for our client portfolios, given the expectation that further slowing in economic growth, ending in recession, will cause yields to fall further. We are grateful that our clients remained steadfast throughout 2022. It can often be difficult to stay the course, staying true to one’s convictions, when the world seems to be taking an opposite perspective. We are also grateful that many of the expectations we shared with clients have come to pass.

Now is the time to take advantage of the knowledge that a recession will be arriving soon, if it has not already. We know high quality fixed income and municipal bonds perform quite well during periods of slow to contracting economic growth. An appropriate simile is that a recession is like an economic hurricane. When a hurricane is approaching, individuals are encouraged to prepare, securing their assets, and taking cover. Continuing with that metaphor, municipal bonds are much like financial plywood that helps investors protect their financial lives, in the midst of an economic storm, protecting investors from significant loss, as they await the return of clearer skies.

Clinton Investment Management News

We want to sincerely thank the advisors and clients we serve for their ongoing trust and confidence. While 2022 was a very challenging year for us all, CIM enjoyed continued to growth. Our firm’s addition to multiple SMA platforms throughout the country is evidence of the highly valued and differentiated nature of our municipal bond investment solutions. These achievements resulted in the largest inflow of new client mandates in our firm’s history during 2022. The strength of our relationships is evident in our growth, and we are deeply grateful for our client’s ongoing commitment, trust, and loyalty.

If you should have any questions regarding this commentary or how one can take advantage of the inefficiencies we see, feel free to reach out to us directly.

Best Regards,

Andrew Clinton

CEO

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product,madereference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Clinton Investment Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. The PSN universes were created using the information collected through the PSN investment manager questionnaire and use only gross-of-fee returns. The PSN/Informa content is intended for use by qualified investment professionals.Please consult with an investment professional before making any investment using content or implied content from any investment manager. A copy of our current written disclosure statement discussing our advisory services and fees is available for reviewupon request.