CIM Market Commentary | Why is the Fed Cutting Interest Rates?

- The recent Bureau of Labor Statistics (BLS) payroll revision showing downward revisions of a record 911,000 jobs in the year through March 2025, further demonstrates the weakness of the current job market.

- The Consumer Price Index (CPI) peaked at 9.1% in 2022 and has since fallen by over 68% to 2.86%, as of August 2025.

- An average of less than 30,000 jobs per month has been created over the past three months.

- The Fed’s caution, while understandable given the uncertainty surrounding public policy and global macroeconomic conditions, has further dampened economic growth, which will likely require the Fed to reduce interest rates more.

- The muni curve slope is now more than double the +120 bps of the US Treasury curve slope, further illustrating the relative cheapness of the longer duration munis.

- No, interest rates are not rising.

- We would recommend extending duration to lock in higher yields for the long term.

Since the launch of the Fed easing cycle in September 2024, some have claimed that the Fed was cutting interest rates for the “right” reasons. The persistent view was that the economy had grown rapidly during the three years following the pandemic. Therefore, an eventual slowdown in GDP growth was to be expected. Some believed that the Fed’s decision to begin cutting rates in September 2024 was not a harbinger of weaker economic growth and deteriorating employment environment, rather, it was a “normalization” of interest rates to a level that was better suited to a slower growth environment. The Fed’s decision to begin cutting the Federal Funds rate was seen as a minor adjustment, necessary to better align financial conditions with a more stable, albeit slower, economic growth trajectory.

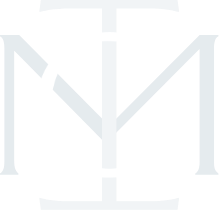

Conversely, our contention has been that the Fed’s decision was, in fact, the launch of a necessary easing cycle, with the goal of forestalling further declines in GDP growth and arresting the decline of what appeared to be a weakening labor force. Our view remains that the Fed did not embark on a path of rate cuts to simply normalize market conditions. We firmly believe the Fed foresaw increasing risks of further economic deceleration and its impact on unemployment, which is why they were compelled to act. We now see the Fed’s actions were not only warranted, but also insufficient, given the downward trajectory of economic conditions and US payrolls that are now evident, as illustrated by last Friday’s extremely weak payroll report, see Figure 1. The recent Bureau of Labor Statistics (BLS) payroll revision showing downward revisions of a record 911,000 jobs in the year through March 2025, further demonstrates the weakness of the current job market.

The Fed’s dual mandates of stable prices and maximum employment have been in tension for some time. While inflation has fallen dramatically since its peak in 2022, job gains, until this year, appeared to be stable. The Consumer Price Index (CPI) peaked at 9.1% in 2022 and has since fallen by over 68% to 2.86%, as of August 2025. The Fed’s stated goal of 2.00% inflation is now within reach, yet some remain fearful that upward pressure from tariffs could cause a reversal in this multi-year, downward trend in CPI. It is important to note that we are not of that view. It remains our expectation that any increase in prices, due to tariffs, will likely prove temporary. Our confidence in the continuation of the broad decline in inflation is supported by the expectation that tariffs are unlikely to increase again in 2026. Therefore, we expect a further moderation in inflationary pressure as we look to the back half of 2026.

Greater concern should now turn to the apparent weakness in the labor market, in our view. The recent release of the August payroll report confirms that a dramatic slowdown in job creation is now occurring. An average of less than 30,000 jobs per month has been created over the past three months. While this outcome was well below the expectations of many strategists, it is consistent with our expectations for a weaker jobs market. Of particular significance is the notion that the US economy is no longer creating sufficient jobs to employ newly formed households, despite the arguable decline in the breakeven rate. This slowdown in jobs and corresponding rise in unemployment requires action by the Fed. Unfortunately, this Fed has been slow to act. The Fed’s caution, while understandable given the uncertainty surrounding public policy and global macroeconomic conditions, has further dampened economic growth, which will likely require the Fed to reduce interest rates more than otherwise would have been necessary, had they been more proactive in their easing.

What does this mean for municipal bond investors?

The muni market has endured a multitude of slings and arrows year-to-date, plagued by uncertainties affecting institutional and retail investors alike. Given these pressures, it should surprise very few that municipal bond returns struggled during the first half of 2025 as the tax-exemption of munis was under threat and the market was forced to absorb the highest level of new issuance in its history. With that uncertainty now fading, given the passage of the One Big Beautiful Bill Act, which preserved the tax-exemption of munis, coupled with steadier technical conditions, we believe that munis are positioned to perform well going forward. Municipal bond yields are now delivering compelling tax-free income that is among the highest in over a decade. Long duration municipal bonds are particularly attractive, in our view, given the high taxable equivalent yields investors can achieve by extending out the curve. We have expressed this view in our strategies to date, and we believe that our client portfolios are well positioned for the expected change in interest rates. The AAA municipal bond curve slope 2s/30s, the additional yield investors receive by extending from 2-year to 30-year maturities, is now +225 basis points. The muni curve slope is now more than double the +120 bps of the US Treasury curve slope, further illustrating the relative cheapness of the longer duration munis.

Given that yields on short-term municipal bonds have fallen year-to-date, they now provide little compensation for the reinvestment rate risk investors are exposed to, should interest rates fall further, as is our expectation. For example, 2-year AAA rated municipal bonds now yield a paltry 2.1% compared to the +4.2% yield that AAA 20-year munis offer, as of 9/8/25. Investors, with a long-term investment horizon, can lock in taxable equivalent yields of approximately 8% to 9% or higher, depending on their tax bracket, final maturity, and state of residence, see Figure 2. When one also considers that the Fed is expected to cut interest rates by 1.50% to 1.75% by the end of 2026, according to the Fed’s Statement of Economic Projections (SEP), we would argue the window of opportunity for investors to act on this opportunity could be closing.

I heard interest rates are rising. Is that true?

No, interest rates are not rising. In fact, interest rates have been declining since the fall of 2023. Yet, one of the common concerns we still hear from investors is that extending the duration of their municipal bond holdings increases risks given expectations for rising rates. We caution that view, as it implies that short-term bonds carry little or no risk. While it is fair to say that short-term bonds are less sensitive to changes in interest rates, they are also now substantially lower yielding. Investors in short-term instruments are at risk of leaving potentially hundreds of basis points of yield and total return on the table, should interest rates continue to fall.

The economy is at an important inflection point. Declining payrolls and slowing growth should sufficiently motivate the Fed to cut rates further. The cutting of interest rates is a realization that economic conditions are too tight, and the US economy has slowed considerably, putting future job creation at risk. Its also reasonable to expect short-term yields on cash and short duration securities to continue falling in the weeks and months ahead. In an effort to overcome the substantial decline in income, investors with large allocations to cash and short duration instruments will likely experience going forward, we would recommend extending duration to lock in higher yields for the long term. For investors paying taxes, the cheapness of municipal bonds, relative to other fixed income investments, presents a compelling opportunity to achieve equity-like returns, just from the tax-free cash flow that municipal bonds offer, with historically lower risks than comparable asset classes. Should interest rates decline further, principal appreciation could also be significant. Given that this investment opportunity will likely prove to be temporary, we recommend clients and advisors act expeditiously to take advantage of the current municipal bond market dislocation while they still can.

Should you have any questions about this commentary or best manner in which to capitalize on the opportunities we are seeing in the market today, please do not hesitate to reach out to us directly.

Kind Regards,

Andrew Clinton

CEO

This material has been provided for informational purposes only and is not intended by Clinton Investment Management to provide and should not be relied on for tax, legal or accounting advice. If such advice is required, please consult with your own tax, legal and accounting advisors.

Please remember that past performance may not be indicative of future results. Net-of-fee performance returns are calculated by deducting the actual Clinton Investment Management, LLC investment management fee from the gross returns. Performance returns include the reinvestment of income and capital gains. Actual results may differ from the composite results depending upon the size of the account, investment objectives, guidelines and restrictions, inception of the account and other factors. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product, made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Clinton Investment Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Please consult with an investment professional before making any investment using content or implied content from any investment manager. A copy of our current written disclosure statement discussing our advisory services and fees is available upon request.

The views and opinions expressed are not necessarily those of the distributing firm or any affiliates. Nothing discussed or suggested should be construed as permission to supersede or circumvent your firm’s policies, procedures, rules, and guidelines.