CIM Second Quarter Market Commentary & Outlook

- Over the last 8 Fed rate hiking cycles, the average return of the 10-year Treasury bond, over the 12 months following a Fed pause is +18.00%, while the average return of the 30-year Treasury Bond is +28% over the same time period.

- The term transitory is not going down without a fight.

- Inflation has declined by more than 67% in less than a year.

- The June payroll number was the weakest jobs report since December of 2020, when the US lost over 200,000 jobs during the COVID crisis.

- 14 consecutive months of declining Leading Economic Indicators, (LEI)’s is a trend that has been associated with recession 100% of the time.

Andrew Clinton

CEO

“The four most expensive words in the English language are, ‘This time is different.”

-Sir John Templeton

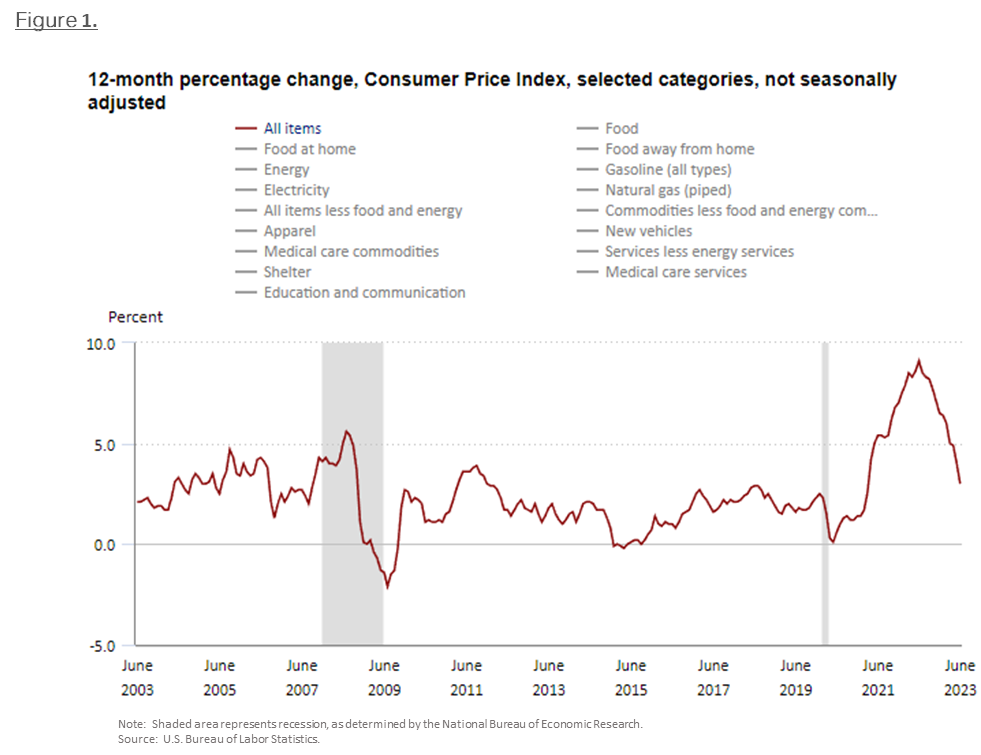

Sir John Templeton’s quote has never been more relevant, in our view. Less than a year ago, central bankers were roundly scolded for suggesting that the inflationary impulse that the US and global economies were experiencing, as they emerged from the largest supply disruption in modern history, was, wait for it… transitory in nature. This term was later largely banished from the Wall Street lexicon, as we were also told, by any number of experts, economists, hedge fund managers, and strategists that inflation was deeply embedded, stubbornly persistent, steadfast, and sticky. The word transitory was replaced with “resilient”, which we now hear almost every minute of every day in headlines, ad nauseum. We learned last week, however, that the term transitory is not going down without a fight. Those same central bankers, who dared to utter the word transitory, now appear to finally be right about one thing; the temporary spike in prices we experienced in 2022, does, in fact, appear to be transitory after all. This is shocking news to many, and yet, confirmation was delivered in the recently released June Consumer Price Inflation (CPI) and Producer Price (PPI) data, which illustrated clearly, that, in less than a year the CPI, which was 9.1% in the Summer of 2022, is now just 3.00%, on a year-over year basis. PPI, at just 0.1% month-over-month, is on the brink of deflation. The fact that inflation has declined by more than 67%, in less than a year, should not come as a surprise to our clients and loyal readers, however. We have been advising investors, for some time, to prepare for inflation to fall, and fall rapidly, once the stimulus induced spending and pent-up Covid savings had run down, see Figure 1.

While the current environment may not feel good, for those of us who are still struggling with the generational price increases we experienced in 2022, we can, at least, take comfort in the knowledge that the pace of further price increases has slowed dramatically. We now know that inflation has declined for four consecutive months and is approaching the Fed’s 2.00% target, at a pace few were expecting at the end of 2022. Therefore, now is the time for investors to carefully consider the most likely market outcomes, going forward. The June US payroll report provides a clue as to what the economy is likely to face in the months ahead. Not only did the establishment survey for US payrolls disappoint, missing expectations by over 20,000 jobs, but the two prior months payroll revisions resulted in an additional 100,000 fewer new jobs than were previously reported. The June payroll number was also the weakest jobs report since December of 2020, when the US lost over 200,000 jobs during the COVID crisis. While payrolls in the US remain positive, for now, it is the future direction of the data that is most concerning to us. We know from history that US payrolls and CPI are lagging economic indicators. As such, the outlook for the broader US economy in the coming months is equally concerning, as we have now seen 14 consecutive months of declining Leading Economic Indicators, (LEI)’s a trend that has been associated with recession 100% of the time. The question remains, how should investors prepare for what markets are likely to experience in the weeks and months ahead?

An appropriate assessment of where we are in the business cycle is essential to determining where we are likely headed.

1) The Fed has paused interest rates hikes. While there is a possibility that the Fed could raise rates one more time, that is less of a concern as we believe we are very close to or have already reached peak Fed Funds.

2) Over the last 6 Fed rate hiking cycles, the average return of the 10-year Treasury bond, in the 12 months following a Fed pause is +18.00%, while the average return of the 30-year Treasury Bond is +28% over the same time period, according to Rosenberg Research.

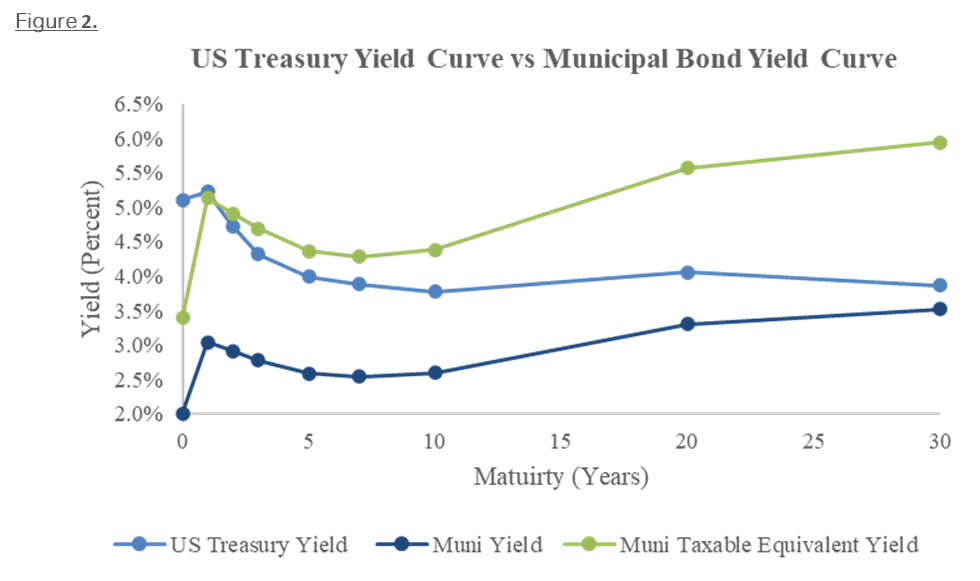

These are important data points, as history is often a reasonable guide and can provide insight into what we can expect going forward. Our long-held view has been that interest rates were likely to fall further going forward, providing long duration fixed income investors with attractive yields and total returns over time. We maintain that view, as we have already seen rates fall from their peak in November of 2022, by over 60 basis points (bps). Investors are also likely to see the yield on short-term cash instruments fall going forward, illustrating the high level of reinvestment rate risk that investors, with large cash and short-term bond positions, are exposed to. The municipal bond curve remains positively sloped by over 0.50% or 50 basis points or 0.50%, between 2 year and 30-year bonds (2s/30s), while the Treasury curve remains inverted 2s/30s by over 80 bps or 0.80%. This dislocation illustrates the relative cheapness of longer duration municipal bonds relative maturities in the 3-to-10-year area of the curve, see Figure 2.

This market inefficiency is driven largely by retail investors misinterpreting what the Treasury curve inversion is signaling to broader markets, in our view. The Treasury curve is clearly indicating that interest rates are likely to be meaningfully lower in the months and years ahead. Therefore, we are strongly encouraging investors to extend their maturities and durations, to lock-in the equity-like, taxable equivalent yields, that our municipal bond strategies now offer. The risk-adjusted return of municipal bonds is more compelling still when one considers that we have not seen two, back-to-back, negative return years, in the municipal bond market, since 1982. Given that we just experienced the worst bond market in roughly 50 years, in 2022, we are not likely to see another bear market in bonds any time soon, in our view. We are confident, however, this unique moment of attractive tax-free yields will not last. Therefore, we are compelling municipal bond investors, with large cash positions and heavy exposure to short/intermediate maturities, to act deliberately and expeditiously, in order take advantage of this unique opportunity to capture the highest level of tax-free yields we have seen in almost 20 years.

If you should have any questions about this commentary or where we are finding the best values in the municipal bond market today, please do not hesitate to contact us directly.

Best regards,

Andrew Clinton CEO

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product,madereference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Clinton Investment Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. The PSN universes were created using the information collected through the PSN investment manager questionnaire and use only gross-of-fee returns. The PSN/Informa content is intended for use by qualified investment professionals.Please consult with an investment professional before making any investment using content or implied content from any investment manager. A copy of our current written disclosure statement discussing our advisory services and fees is available for reviewupon request.