CIM Second Quarter Market Commentary & Outlook

Key Considerations:

- The economy has already begun to slow rapidly

- The US economy has continued to contract in Q2, according to the Atlanta Fed’s GDPNow -1.2% forecast

- The US economy may already be in recession

- The recent rise in tax-free muni yields has created a window of opportunity through which investors can now capture very attractive yields, which, on a taxable equivalent basis, rival the nominal, annualized returns that are often associated with much higher risk assets

- A hard landing is increasingly becoming the base case for the US economy

- We are recommending investors with exposure to short-term municipal bonds consider seriously moving out of what we believe are the most unattractive short-term, high-quality maturities and extend into longer duration bonds

- High quality short-term munis are trading at the lowest yield-to-Treasuries ratio, 55%, that we have seen since the beginning of this year

Andrew Clinton

CEO

Interest rates rose meaningfully during the second quarter, largely due to investor fears that peak inflation would persist, or worse accelerate, which would force the Federal Reserve to hike interest rates dramatically as it seeks to return inflation to its 2% target. Consistent with the expectations we shared in our Q1 Market Commentary, the economy has already begun to slow rapidly, as evidenced by the -1.6% contraction in GDP in Q1. The US economy has continued to contract in Q2, according to the Atlanta Fed’s GDPNow -1.2% forecast. This is extraordinary as the second quarter of the year has historically been one of resurgent growth. This is an ominous signal for the direction of the economy going forward in our view. Two quarters of back-to-back contraction in economic activity is consistent with the technical definition for an economic recession. Therefore, the US economy may already be in recession. Market strategists have broadly dismissed this reality, preferring to place their faith in the hope that the Fed can orchestrate a soft landing instead. This can be seen clearly in the Bloomberg survey of economists, which in May placed the odds of a US recession in the next 12 months at barely 30%. As our loyal readers may recall, Clinton Investment Management (CIM) noted the slowing economic data in Q1 and recommended investors begin preparing for recession, as we believed a material slowing in economic growth would result in the destruction of wealth through a significant devaluing of risk assets. We now know that those concerns were warranted, and our advice was well placed, as the asset classes that inflated the most, due to fiscal stimulus and quantitative easing, including crypto currencies, equites, high yield bonds, and even the broader commodity complex, have all seen significant price declines and the destruction of trillions of dollars of wealth, removing liquidity from the market, just as the Fed intended.

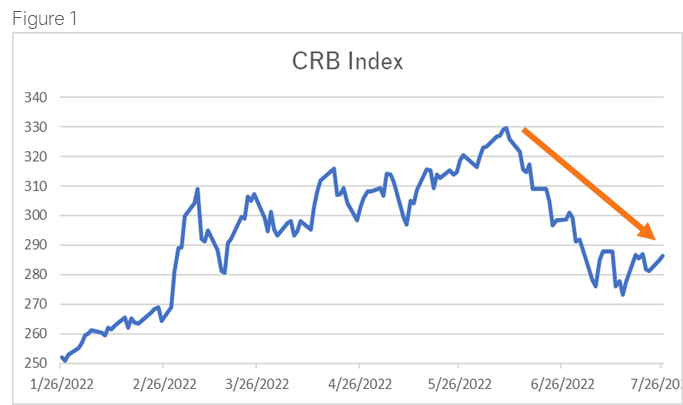

US economic data has turned decidedly negative as illustrated by the recent Pending Home Sales, -19.8% year-over-year, New Home Sales, -8.1% month-over-month, while weekly jobless claims have risen for four consecutive months and now stand at +244,000. Almost the entirety of the commodities complex has turned meaningfully lower as well. Raw materials prices are now falling, see Figure 1. This is very good news for anyone concerned about the level of inflation going forward.

It is now clear to us that the average consumer is not strong at all, contrary to what many would have us believe. These conditions, taken together, support our view that inflation has likely peaked while US and Global economic growth continues to decline, as the Fed continues to tighten financial conditions at a pace we have not seen in almost twenty years.

Bell-weather, multinational corporate earnings from Walmart, Amazon, Target, Best Buy, and now AT&T have deteriorated much faster than expected. AT&T’s recent earnings miss was particularly alarming as it speaks directly to the general health of the millions of consumers it serves. AT&T specifically stated that its earnings where meaningfully impaired by “delayed” payment of bills by its customers. When we consider that revolving consumer credit, in the form of credit card debt, has exploded year-to-date, the reality that consumers are now struggling to simply pay their phone bills raises serious concerns about the degree of economic pain consumers are experiencing, as well as the deterioration in their personal balance sheets they are enduring. It is now clear to us that the average consumer is not strong at all, contrary to what many would have us believe. These conditions, taken together, support our view that inflation has likely peaked while US and global economic growth continues to decline, as the Fed continues to tighten financial conditions at a pace we have not seen in almost twenty years.

The broader bond market is just now beginning to price in the probability of a recession in the near-term. Indications of this can be seen in the more than 60 basis point decline in 10-year Treasury yields, from a high of 3.40% to 2.76%, at the time of this writing. The broader market narrative has shifted dramatically from a fear of inflation to a fear the Fed will make or may have already made, the policy mistake of tightening too much, as they have in every other US expansion in history. We share this fear as it is our expectation the Fed will indeed go too far, including the 75 basis point increase in the Federal Funds rate expected this month. A hard landing is increasingly becoming the base case for the US economy. As a result, the Treasury yield curve has begun to flatten meaningfully, as yields on short-term bonds have surged higher while long-term bonds yields have fallen. This bear flattening of the curve has resulted in two-year Treasury yields now yielding more than 30-year bond yields, a conditioned referred to as an inverted yield curve. The inverted curve slope of the entire curve is extremely important as it has been an excellent predictor of recession over the course history, with roughly 90% accuracy.

Given that the Fed has just begun raising “short-term” interest rates, and unwinding its tremendous balance sheet, via Quantitative Tightening (QT), we believe the curve could become deeply inverted in the not-too-distant future. QT is the Fed policy that results in the Fed allowing what is expected to be over $90 billion a month in marketable securities it holds on its balance sheet to mature without reinvestment of the proceeds. Given that the US Treasury will be forced to issue new Treasury bonds to fund the US’s ever growing debt obligations, investors and banks will be forced to buy those securities the Fed would have purchased otherwise, thereby removing additional liquidity from the market, resulting in a further crowding out of investment in risk assets more broadly in our view.

While municipal bond yields have largely moved up in sympathy with Treasury bond yields over the past six months, munis continue to clearly demonstrate their wealth preservation qualities as the asset class remains, not only the best performing, fixed income asset class on a relative return basis, but they have also outperformed domestic and global equity markets as the value of municipal bonds have declined by a smaller degree. It is worth noting, that the recent rise in tax-free muni yields has created a window of opportunity through which investors can now capture very attractive yields, which, on a taxable equivalent basis rival the nominal, annualized returns that are often associated with much higher risk assets.

Credit quality in the municipal bond market remains the strongest it has been in over two decades due to an unexpected flood of higher tax collections, together with over $500 billion in stimulus money that was delivered to state and local governments, schools, and hospitals via the American Rescue Plan in 2021. As the economy slows and interest rates decline further, municipal bond investors are likely to benefit from the lower risk and higher tax-free cash flow munis provide, while enjoying the potential for principal appreciation associated with falling interest rates and the flattening of the muni curve.

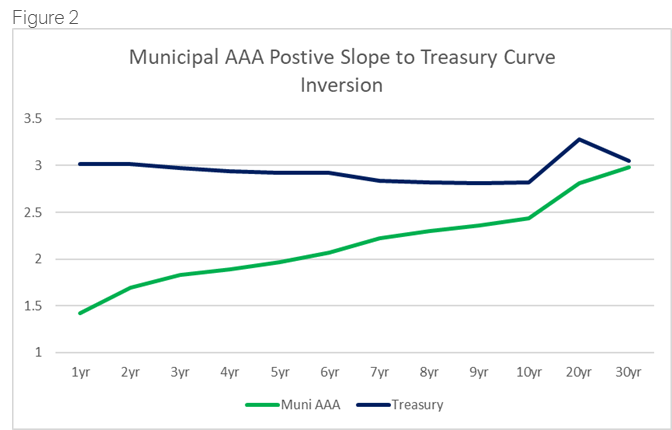

As we discussed recently, the current slope of the Treasury yield curve is inverted -8 basis points between two year and thirty-year Treasury bonds (2s/30S). What is fascinating is that this condition does not exist in the municipal bond market. The 2s/30s slope in the muni market is actually +129 basis points, see Figure 2. This positive slope provides additional yield incentive to investors to extend out the curve as the muni market is structurally mispriced relative to Treasuries. This dislocation and inefficiency between munis and Treasuries occurs on rare occasions, largely due to retail investor outflows from mutual funds, as has been the case year-to-date. A record +$80 billion has flowed out of the municipal bond mutual funds year-to-date as panicked retail investors sell first and ask questions later, leaving extraordinary value in their wake, in our view.

This positive slope provides additional yield incentive to investors to extend out the curve as the muni market is structurally mispriced relative to Treasuries. This dislocation and inefficiency between munis and Treasuries occurs on rare occasions, largely due to retail investor outflows from mutual funds, as has been the case year-to-date.

We believe these investors are not sufficiently heeding the important economic signal the long-end of the Treasury market is sending. As a result, we are recommending investors with exposure to short-term municipal bonds consider seriously moving out of what we believe are the most unattractive short-term, high quality maturities and extend into longer duration bonds. We believe the long end of the muni market does not accurately reflect slowing growth prospects and the probability of lower interest rates going forward. The opportunity costs of staying in short maturities in our view is, therefore, quite high. High quality short-term munis are trading at the lowest yield-to-Treasuries ratio, 55%, that we have seen since the beginning of this year, when ratios were at record lows. On the contrary, ratios of long-term munis are over now 100%, which implies the tax-exemption of munis is largely worthless. This presents a rare opportunity for almost anyone, in any tax bracket, to benefit from the attractive value that long-term munis now offer, especially given our expectation that materially higher interest rates are unlikely going forward. Lastly, the recent rise in short-term bond yields has generated capital losses for investors that can be harvested with the goal of modestly extending duration to pick up higher tax-free yields and higher total return over time.

The impact of Fed action, now and in the future, cannot be overstated. Therefore, we are encouraging investors to prepare for the high likelihood of recession by increasing their exposure to assets that carry less risk, including cash, high quality longer duration fixed income, and municipal bonds in particular. Given the very attractive yields on a tax-free and taxable equivalent basis that munis provide, we believe clients are being well compensated as they await the deepening of the recession and a corresponding decline in interest rates.

Clinton Investment Management News

We are excited to share there our strategies were recently launched on the Morgan Stanley platform and are now available to over 16,000 Morgan Stanley advisors and their clients. We would also like to invite you to visit us at our new website www.clintoninvestment.com to view additional content about our firm and our strategies.

Please do not hesitate to contact us with any questions regarding this piece or the current market opportunity we are now seeing.

Best Regards,

Andrew Clinton

CEO

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product,madereference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Clinton Investment Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. The PSN universes were created using the information collected through the PSN investment manager questionnaire and use only gross-of-fee returns. The PSN/Informa content is intended for use by qualified investment professionals.Please consult with an investment professional before making any investment using content or implied content from any investment manager. A copy of our current written disclosure statement discussing our advisory services and fees is available for reviewupon request.