History of Municipal Bond Market Volatility and Price Corrections

Given recent municipal bond market volatility, we thought it would be helpful to provide historical context and perspective through the lens of prior periods of interest rate fluctuations. We’ve drawn parallels to the most recent episode as we are reminded of the prescient Mark Twain observation that “history does not repeat itself, but it often rhymes.”

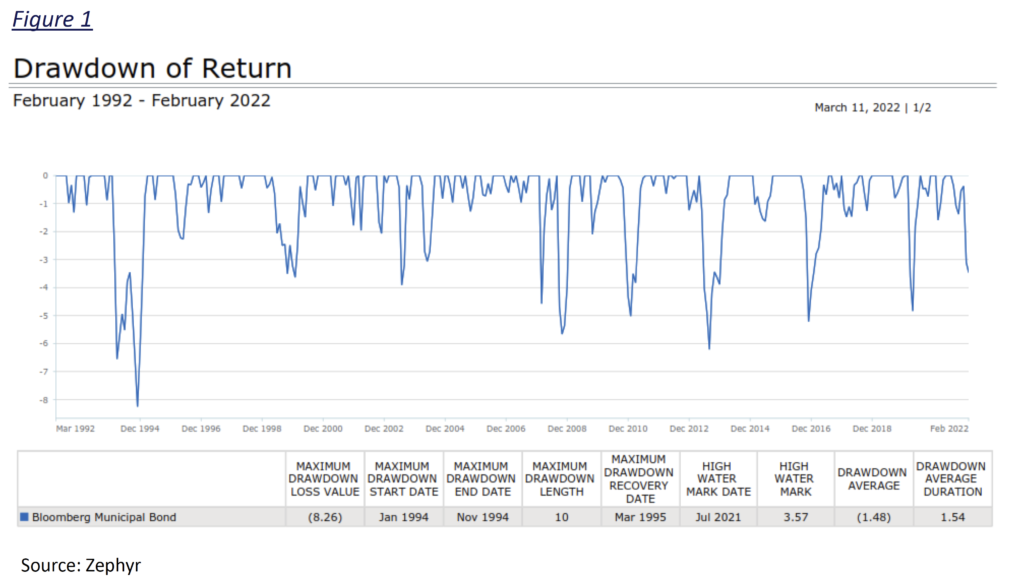

For investors new to municipal bond investing, it is important to note that periods of rising municipal bond yields are quite common and should be expected. As you can see in Figure 1 below, over the last thirty years, there have been numerous instances of rising municipal bond yields, thirteen of which resulted in drawdowns of greater than -2.00%.

Through the analysis of this data, one can see that episodes of rising municipal bond yields and corresponding bond price drawdowns are both temporary and self-correcting. While the corresponding drawdown in principal value associated with these periods of rising yields may be unwelcome and concerning for investors, we are reminded that rate fluctuations are a natural condition associated with periods of economic and geopolitical uncertainty. This moment is no different. As students of the market, we draw confidence from the knowledge that business cycles have clearly defined beginnings, known as expansions, followed by economic contractions, known as recessions. We also know that, over the course of history, recessions have been caused by one of three powerful economic forces including wars, inflation, and Federal Reserve interest rate tightening cycles. What makes this moment truly extraordinary is the harsh reality that the US economy is faced with all three of these forces at the same time. These negative economic impulses are expected to accelerate the end of the current expansion, bringing forward recession. The knowledge, that a recession is forthcoming, should provide confidence to bond holders who may be concerned by the recent move higher in rates, as interest rates are expected to fall as growth slows and the current expansion ends.

While headlines and news may understandably be alarming, it is important to note that we have experienced similar episodes of this nature over time. Periods of uncertainty can create anxiety for us all. However, it is in these moments of uncertainty that we must refocus our minds on the fundamental principles of successful investing, while doing our best to control our emotions. We often remind our clients that one of the most important principles of successful investing is to remain calm and firmly committed to one’s long-term investment horizon and goals. For example, we encourage the investors we serve to maintain investment horizons that are consistent with a full business cycle. This commitment enables investors to see past current market volatility, in order to enjoy the benefits of the recovery in bond prices that are associated with eventual recessions. The essentiality of an investor’s commitment to this central tenet cannot be overstated, as it provides investors with confidence and comfort in their knowledge that rates will decline once this expansion ends, in the not-so-distant future.

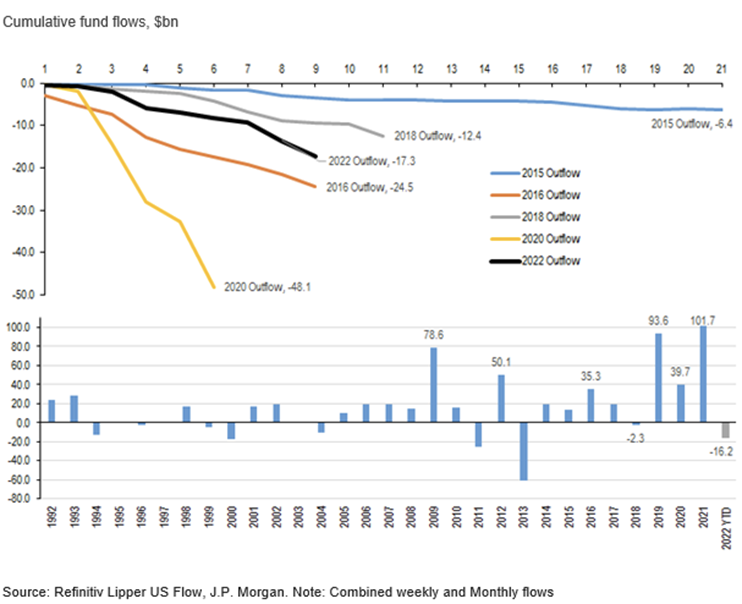

While a deep knowledge of economic forces and market history are vital for sophisticated investors to achieve success in the municipal bond market, it is also critical to understand the tendencies of investors who may not have the same access to this knowledge or have the same benefit of experience. Free markets enable investors to make decisions for a host of reasons which, unfortunately, may be inconsistent with an investor’s best interests. An illustration of this can be seen in the nine consecutive weeks of municipal bond fund outflows we have seen year-to-date. This outflow cycle has been the primary cause of the recent rise in municipal bond yields and the corresponding decline in prices. Treasury bond yields began rising in January dragging the yields of municipal bonds higher. The common reaction of retail investors in municipal bond funds is to sell their mutual fund holdings at the first indication of a negative return on a fund’s Net Asset Value. This overreaction triggered cascading redemptions of open-end and exchange traded municipal bond funds. These redemptions have resulted in forced selling by fund managers into a municipal bond market that has thus far been disinclined to step forward to bid on securities, given that broker dealers have substantially reduced their committing capacity for municipal bond trading, over the past twenty years. From our Econ 101 classes we know that a greater supply of bonds for sale with diminished demand for those bonds, results in lower prices, at least until those bids, has persisted resulting in negative returns for municipal bond investors year-to-date. The current outflow cycle is now among the longest in the history of the municipal bond market.

It is important to note that the dual windfalls of dramatic revenue increases, resulting from unexpectedly high municipal tax collections, together with the over half a trillion dollars in fiscal support delivered to municipalities by the American Rescue Plan, have delivered the strongest outlook for municipal credit quality in decades. It is also important to remember that during prior periods of rising interest rates, the majority of the broader rate increase has occurred prior to the first Fed rate hike. We firmly believe that this moment presents an attractive entry point for investors, given the Fed’s plans to start hiking rates this week. We are, therefore, encouraging investors to revisit their investment goals and horizons to determine if they can take advantage of this unique window of opportunity.

If you should have any questions regarding this commentary or the municipal bond market more broadly, please feel to reach out to us directly.

Sincerely,

Andrew Clinton

CEO

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product, made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Clinton Investment Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. The PSN universes were created using the information collected through the PSN investment manager questionnaire and use only gross-of-fee returns. The PSN/Informa content is intended for use by qualified investment professionals. Please consult with an investment professional before making any investment using content or implied content from any investment manager. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.