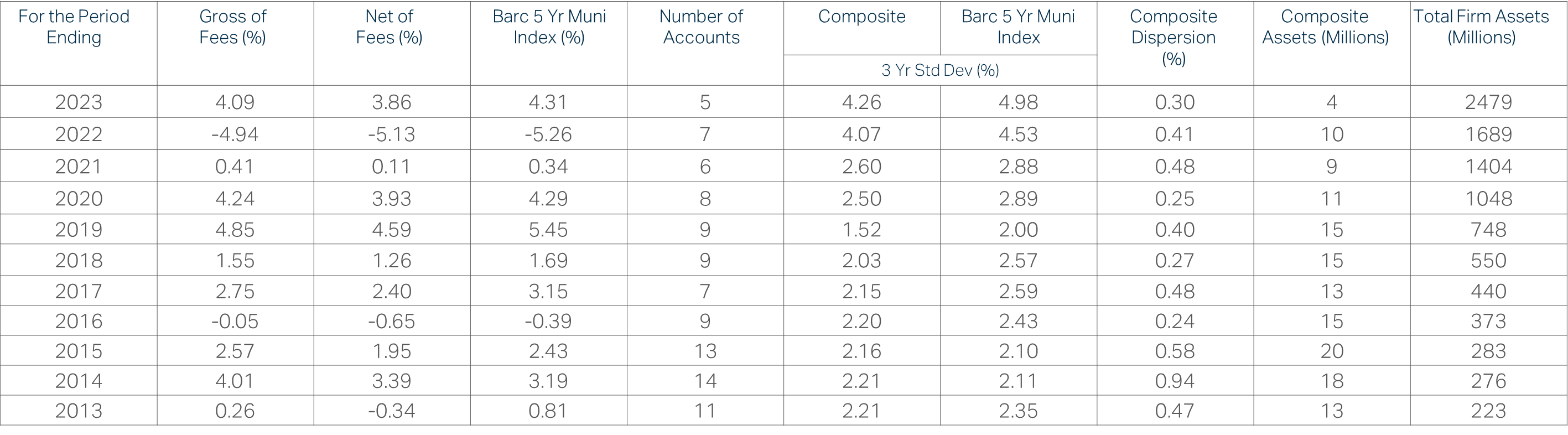

Municipal Short Duration

Annualized Returns (%)

As of 12/31/2024

Inception Date: 09/30/2009

Returns less than one year are not annualized. Net of fee performance is net of actual fee.

Past performance is not a guarantee of future performance.

Growth of $1 Million

Annualized Return

| QTD | YTD | 1 YEAR | 3 YEAR | 5 YEAR | 10 YEAR | *SINCE INCEPTION | |

| Municipal Short Duration - Gross | -0.51% | 1.34% | 1.34% | 0.09% | 0.97% | 1.64% | 2.24% |

| Bloomberg 5 Year Muni Bond Index | -1.04% | 1.17% | 1.17% | -0.01% | 0.91% | 1.67% | 2.26% |

| Municipal Short Duration - Net | -0.54% | 1.17% | 1.17% | -0.10% | 0.73% | 1.36% | 1.93% |

Portfolio Characteristics

CURRENT YIELD

4.42%

YIELD TO MATURITY

3.40%

YIELD TO WORST

3.25%

TAXABLE EQUIVALENT YIELD TO WORST*

5.49%

The taxable equivalent yield represents the yield that must be earned on a fully taxable investment in order to equal the tax-exempt yield of the particular composite. The taxable equivalent yield is calculated by dividing the tax exempt yield by 1- the maximum federal income tax rate of 40.8% (37% federal + 3.8% Medicare tax).

Sector Distribution

Years to Maturity Distribution

Clinton Investment Management LLC (CIM), a SEC registered investment adviser, claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. CIM has been independently verified for the periods May 31, 2007 through December 31, 2023. The verification report is available upon request. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Please review the firm's ADV for additional information about risks and fees. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. Verification does not provide assurance on the accuracy of any specific performance report.

Notes:

1. CIM is an independent registered investment adviser. CIM was established in 2007 and primarily manages fixed income products for high-net-worth, ultra-high-net worth, and institutional clients.

2. The Short Duration composite includes portfolios that invest in municipal bonds. The objective of the composite is to track and/or outperform the benchmark in any given cycle. This strategy is to have a portfolio duration that is similar to that of its benchmark, the Bloomberg Barclay’s 5 Year Municipal Bond Index. Other major statistical factors are considered when constructing portfolios but may not be primary constraints such as duration position, sector allocation, and credit quality. Leverage and derivatives are not used.

3. The composite consists of fully discretionary, fee paying accounts under management, including terminated accounts for the period they were fee paying accounts. The composite's creation and inception date is *September 30, 2009.

4. The US dollar is the currency used to express performance.

5. The benchmark for the composite is the Bloomberg Barclay’s 5 Year Municipal Bond Index which measures the performance of the US municipal bond universe. It includes approximately 5,387 municipal issuers. It is constructed to provide a comprehensive and unbiased municipal bond market barometer for investment grade bonds with maturities from 4-6 years. Please note an investor cannot invest directly in an index.

6. Gross-of-fees performance returns represent returns prior to the deduction of management fees but after all trading expenses. Net-of-fees performance returns are calculated by deducting the actual investment management fee from the gross returns. Accounts may be charged additional advisory fees on top of CIM’s investment management fee.

7. The performance numbers include the reinvestment of income and capital gains.

8. Internal dispersion is calculated when five or more portfolios were in the composite for the entire year using the Gross asset-weighted standard deviation of those portfolios that were included in the composite for an entire year. The 3-Year Standard Deviation represents the annualized standard deviation of actual Gross composite and benchmark returns, using the rolling 36-months ended each year-end.

9. Past performance is not indicative of future returns. Actual results may differ from the composite results depending upon the size of the account, investment objectives, guidelines and restrictions, inception of the account and other factors. Investments in the strategy carry risks, including possible loss of principal. Carefully consider the Strategy’s investment objectives, risks, and expenses before investing. Certain information has been obtained from third-party sources believed to be reliable, but we cannot guarantee its accuracy or completeness.

10. The fee schedule is: 0.60% on the first $1 million in assets, 0.50% for the next $5 Million and 0.37% thereafter. Investment advisory fees are negotiable based on account size, investment strategy and relationship type and may differ between accounts.

11. Policies for valuing portfolios, calculating performance, and preparing GIPS Reports and a list of composite descriptions are available upon request.

12. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

Ratings: The Ratings Distributions are derived by using a weighted average of all credit ratings in the portfolio. The average is calculated by CIM using NRSRO ratings.