The Time to Extend Municipal Bond Duration Has Arrived

- Over the last 8 Fed rate hiking cycles, the average return of the 10-year Treasury bond, over the 12 months following a Fed pause is +18.00%, while the average return of the 30-year Treasury Bond is +28.00% over the same period, according to Rosenberg Research.

- Inflation has declined by more than 67%, in less than a year, and is now just 1% above the Fed’s long-term target of 2.00%. Owners’ Equivalent Rent, which represents roughly a third of CPI, is expected to fall meaningfully in the months ahead.

- San Francisco Fed research, recently released, indicates the US housing market is likely to be experiencing deflation in 2024.

- The June Non-Farm Payroll (NFP) number was the weakest jobs report since December of 2020, when the US lost over 200,000 jobs following the COVID crisis. July NFP of 187k was also below expectations while August was the third consecutive month below 200k jobs created.

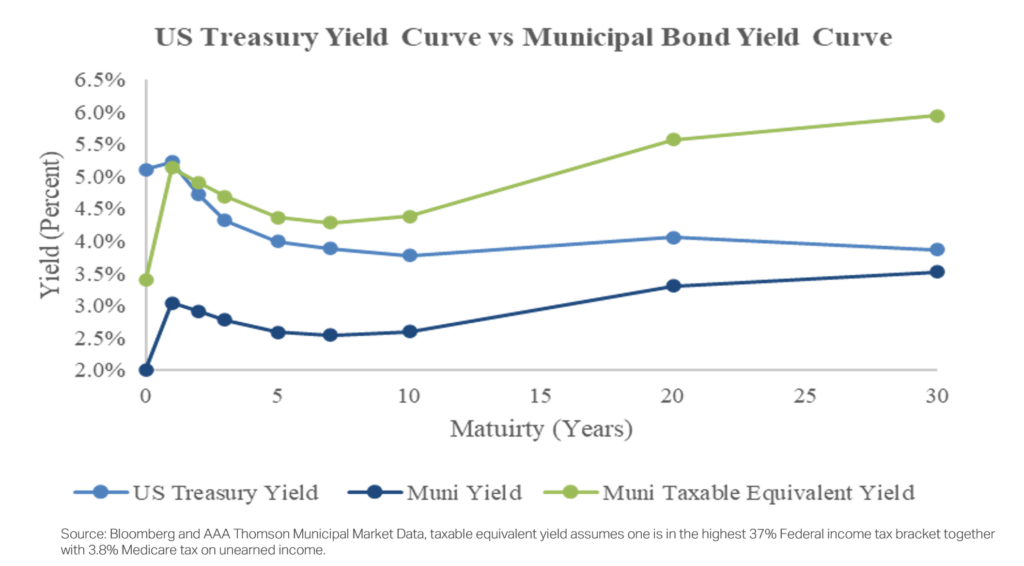

- The muni yield curve is positively sloped by over 0.60% or 60 basis points 2s/30s, according to Thompson Municipal Market Data, while the Treasury curve is inverted by 0.60% or 60 bps. The muni curve remains inverted between 2-year bonds and 13-year bonds, making the intermediate area of the curve unattractive from a total return perspective, over the next 12 months.

- Extending duration to lock in higher yields, while implementing a barbell position as it relates to one’s duration exposure, is optimal in our view.

- For those in the highest tax brackets, investors can achieve equity-like returns, on a taxable equivalent basis, in longer duration munis, given the high tax-free yield munis now offer. An added benefit is the risk of the 40% drawdown that is typically associated with public equities, every decade or so, is extremely unlikely in the municipal bond market, in our view.

Additional Insights

August 30, 2023

Clinton Investment Management, CEO and founder Andrew Clinton joined Bloomberg Intelligence’s Eric Kazatsky and Karen Altamirano on the FICC Focus weekly podcast on fixed income, credit, currencies, and commodities. In this episode—”Active Management, Fixed Income Chaos: Masters of the Muniverse”—they discuss the muni market, expectations around recession, and general outlook post-Jackson Hole and for the fourth quarter ahead.

Listen to the full podcast on:

Apple Podcasts

Google Podcasts

Spotify Podcasts

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product, made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Clinton Investment Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Please consult with an investment professional before making any investment using content or implied content from any investment manager. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.