- Personal Consumption Expenditures (PCE), the Fed’s preferred measure of inflation, has declined for 14 consecutive months providing further confidence that the path of inflation should continue to be lower.

- US Real GDP growth has declined materially, falling by over -67% since the third quarter of last year.

- US households are now carrying the highest levels of housing and non-housing debt in a generation.

- The impact of diminished consumer spending can be seen in the meaningful slowing in retail sales over the past two months.

- The -408,000 jobs that were lost last month, according to the May household survey, could be a harbinger of what the US economy is likely to face going forward.

- Covid savings has been spent.

- Investors with large allocations to preferred savings and cash, may be unaware of the significant reinvestment risk they are exposed to in these short duration instruments.

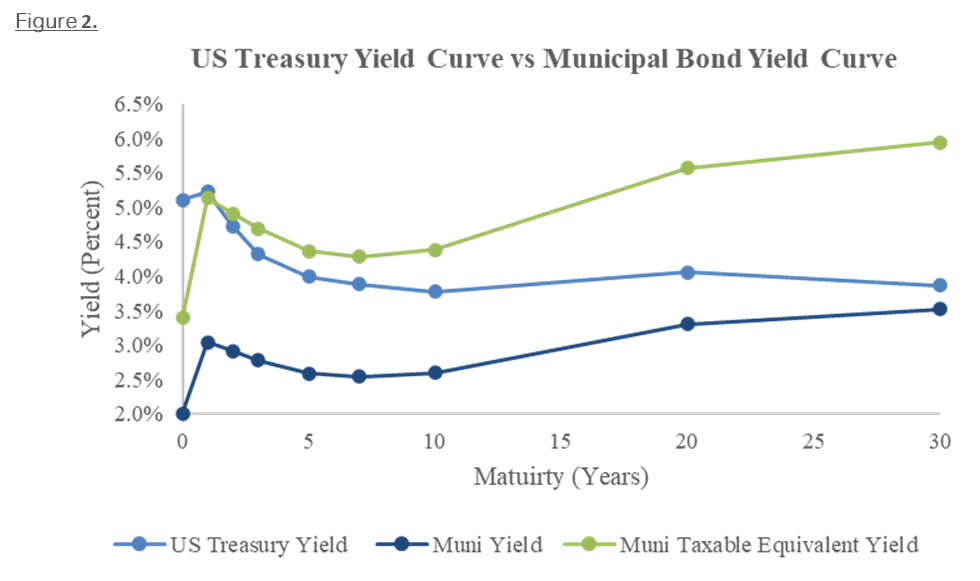

- Municipal credit quality remains stable, and the muni curve remains steep providing an attractive opportunity to extend duration and pick up yield by increasing weightings to lower investment grade and below investment grade munis.

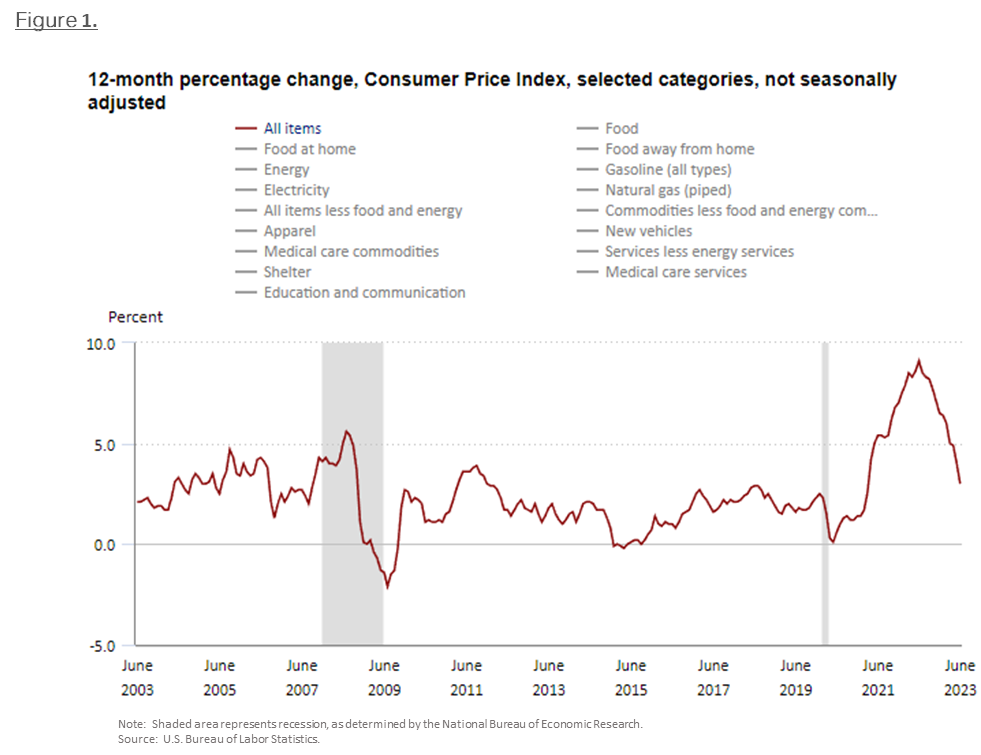

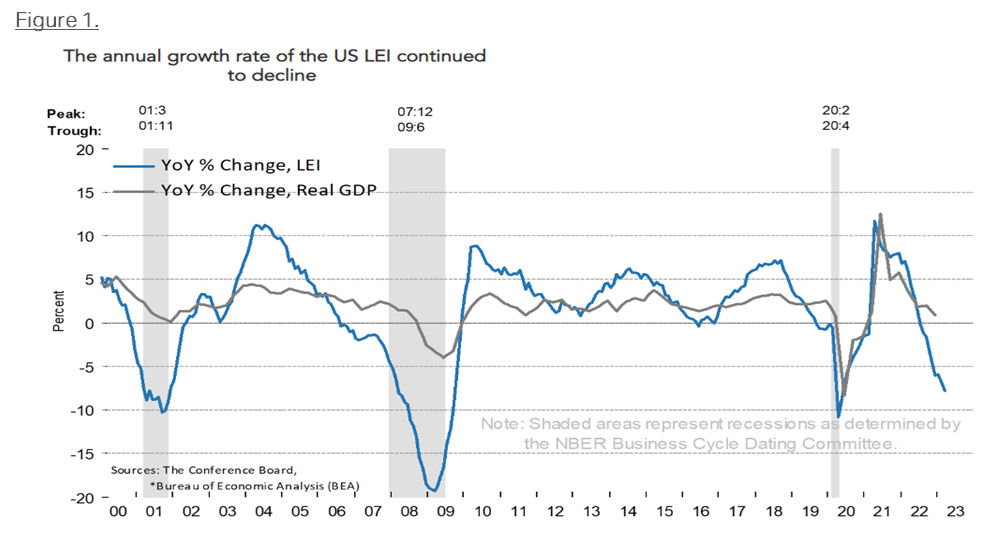

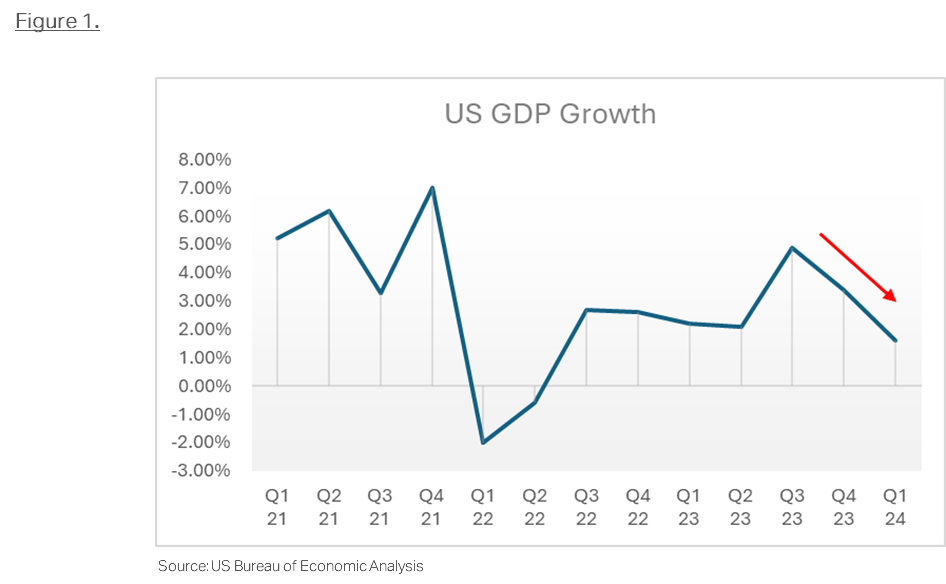

Financial markets have posed a number of vexing questions to investors over the past two years, not the least of which included the height to which interest rates could rise without negatively impacting US economic activity. The answer appears to now be evident. Recent economic data, see Figure 1, clearly illustrate that one of the fastest and most severe interest rate hiking cycles in history is having its desired negative impact on GDP growth. The meaningful moderation in economic activity we are now witnessing is, no doubt, guiding the Fed’s caution and ultimate decision to pause rate hikes, having now kept them on hold for over eight months.

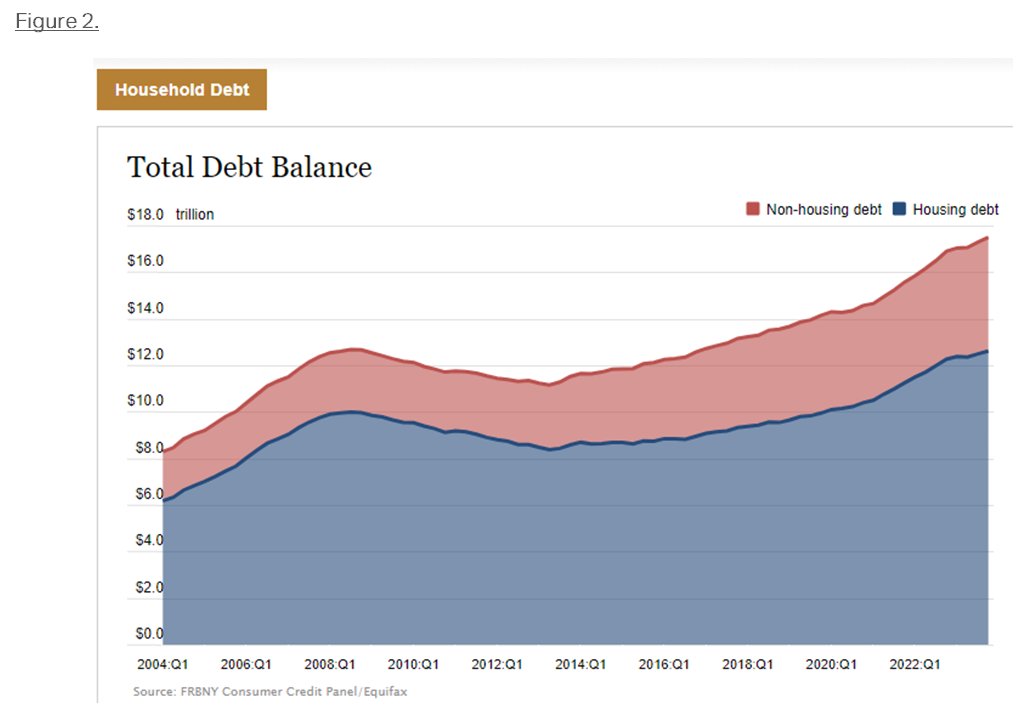

During this time, US Real GDP growth has declined materially, falling by over -67% since the third quarter of last year. Although many market participants were surprised by the +4.9% GDP growth rate of Q3 of 2023, what was less surprising was that that growth could not be sustained. The extremely weak +1.3% GDP growth of the first quarter of 2024 is a clearer representation of the current state of the broader economy, in our view. The recent downturn also increases the risk that the US economy could dip into recession in the months ahead. Some might argue, and rightfully so, that there are still segments of strength in the US economy, such as areas of technology driven by the incredible speculative fervor surrounding Artificial Intelligence (AI). Yet, we are now seeing broad inflation and price moderation across every Fed region in the country, according to the Fed’s Beige Book. Moreover, since the economic reopening, following Covid, we have also heard much about the strength and “resilience” of the US consumer. On the contrary, we are now seeing clear signs US consumers are anything but healthy, as they are now carrying an enormous debt burden, just as their Covid savings have been depleted. Retail spending has decelerated while consumer credit card debt has exploded to levels above those prior to Covid. The difference this time is that the interest rates associated with that credit card debt is approaching 30%, placing an extraordinary burden on consumer balance sheets. US households are now carrying the highest levels of housing and non-housing debt in a generation, see Figure 2, while interest rates are among the highest many have seen in their lifetimes.

The impact of diminished consumer spending can be seen in the meaningful slowing in retail sales over the past two months. Further indications of the struggle US consumers are facing can be seen in the recent earnings weakness and forward guidance reported by consumer-discretionary companies, such as Starbucks, McDonalds, Target and Walmart, among others. Business profitability will be negatively impacted, unless businesses pivot to cutting expenses to preserve margins. Cost cutting will likely include employee layoffs at scale. For this reason, we believe the -408,000 jobs that were lost last month, according to the May household survey, could be a harbinger of what the US economy is likely to face going forward. As a result, we believe the unemployment rate will continue to rise as payrolls are further rationalized. This combination of increased job losses and weaker discretionary spending will likely lead to slower economic growth, placing further downward pressure on inflation.

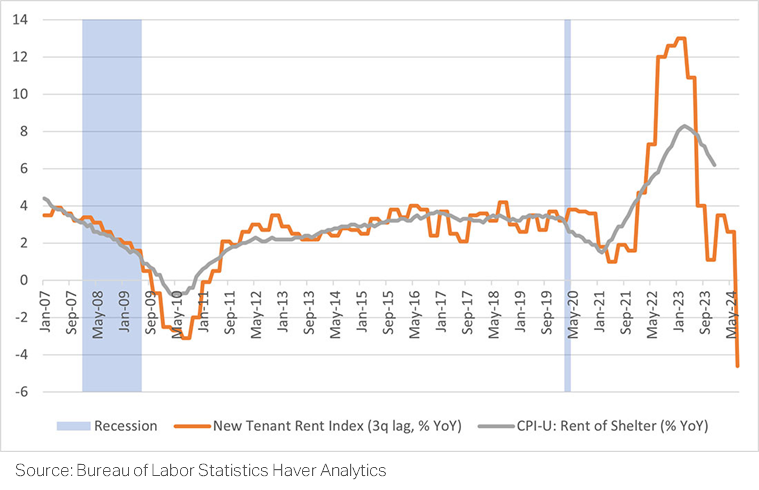

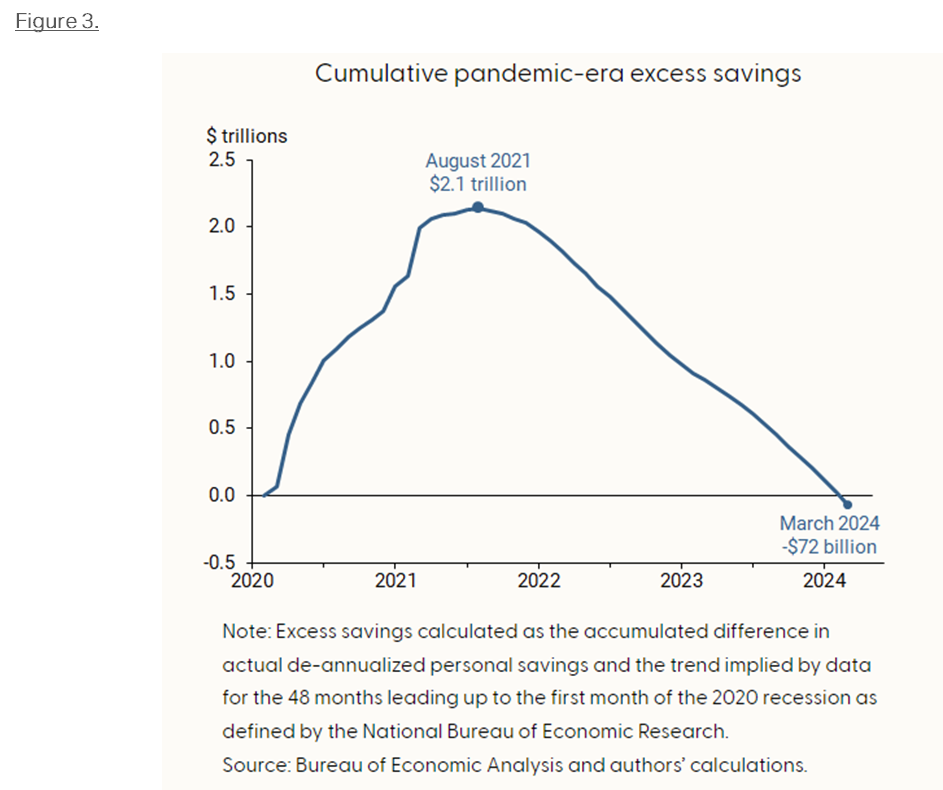

For those who are concerned that inflation will remain stubbornly high for the foreseeable future, we would direct you to Figure 3, which should provide comfort as the Covid savings consumers accumulated has now been spent, leaving very little flexibility to endure further price increases.

It is also worth noting that Personal Consumption Expenditures (PCE), the Fed’s preferred measure of inflation, has declined for 14 consecutive months, providing further confidence that the path of inflation should continue to be lower. We believe that the inflation catalysts of supply chain disruptions and geopolitical strife will likely continue to diminish over time as well, resulting in the Fed being forced to cut rates. The Fed’s decision to pair back its Quantitative Tightening (QT) policy, provides further evidence that the FOMC believes financial conditions are too tight and increasingly are likely to take a toll on economic growth, without a proactive easing of rates soon.

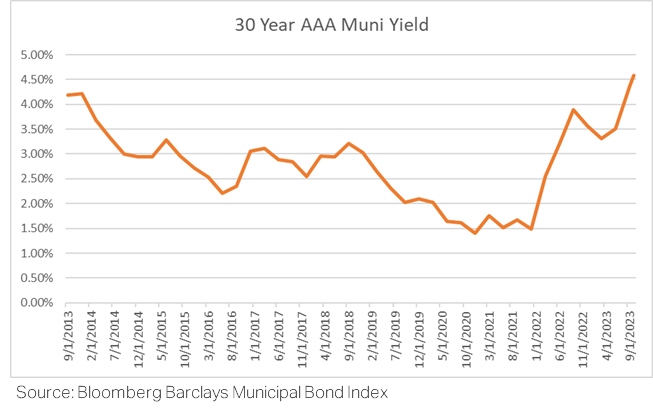

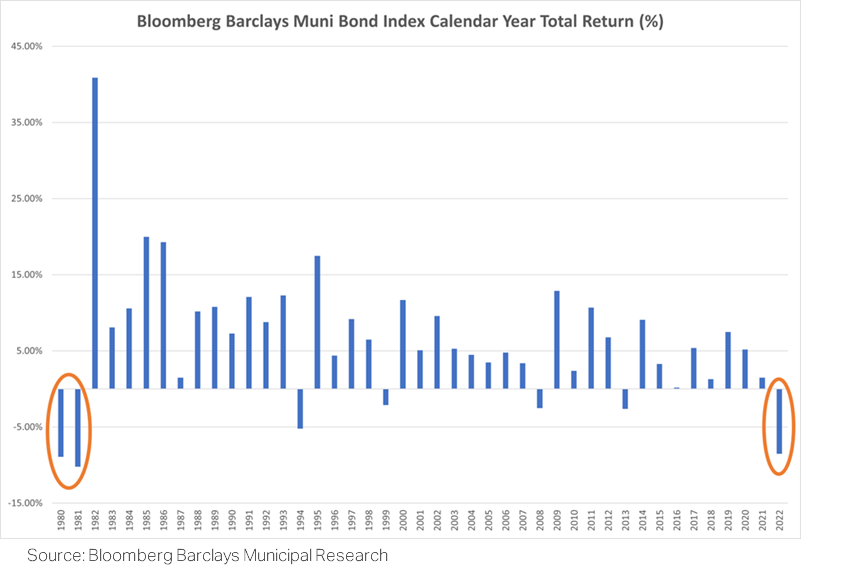

Given the meaningful moderation in growth we are witnessing, we are compelled to draw attention to the risks investors face going forward, as we carefully consider the future direction of interest rates. While the Fed has indicated that rate cuts may not come for some time, they have all but promised us that they will eventually come. Therefore, we are of the belief that high quality fixed income can be expected to deliver attractive returns on a risk-adjusted basis going forward. Like no time in recent memory, we have become increasingly concerned about investors with large allocations to preferred savings and cash, as they may be unaware of the significant reinvestment risk they are exposed to in these short duration instruments. Were interest rates to fall as significantly as we expect, in the months and years ahead, the high cash flow and principal appreciation one could capture today may be lost.

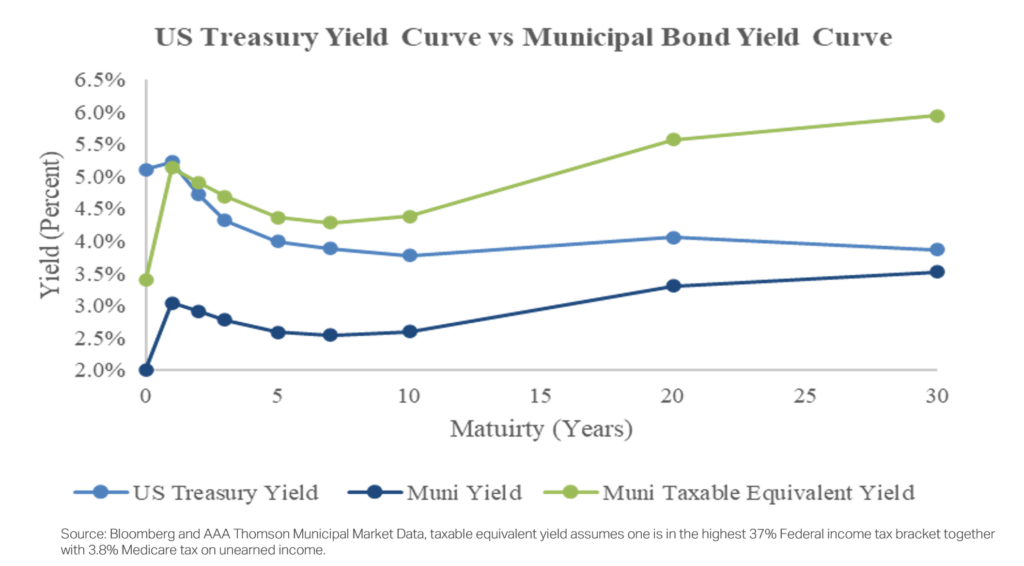

Within our municipal bond strategies, we have begun extending durations to take advantage of the steep slope of the muni curve, which does not exist along the Treasury curve, to lock in higher yields, as we believe interest rates peaked in October of 2023. We are also seeking to better position client portfolios for the likely near-term decline in interest rates we expect, due to Fed forward guidance and Fed action over the coming months. Municipal credit quality remains stable, presenting the opportunity to increase weightings to lower investment grade, and below investment grade munis, for our Municipal Credit Opportunities strategy. Fundamental outlooks remain solid and stable providing an opportunity to capture higher yields without materially increasing investor risk exposures.

We are comforted by our firm belief that our strategies and client portfolios are well positioned for what the future holds. Municipal credit quality remains extremely solid as upgrades continue to outnumber downgrades by a meaningful margin. When one considers the dramatically lower default rates of municipal bonds relative to corporates, the risk-adjusted returns munis deliver are even more compelling, in our view. While we expect the months ahead to be increasingly uncertain, we also expect our strategies to remain a source of stability and enhanced tax-free cash flow for years to come.

If you should have any questions about our strategies, the content in this commentary, or the municipal bond market more broadly, please do not hesitate to reach out. We would be happy to address any questions you may have.

Best Regards,

Andrew Clinton

CEO

Please remember that past performance may not be indicative of future results. Net-of-fee performance returns are calculated by deducting the actual Clinton Investment Management, LLC investment management fee from the gross returns. Performance returns include the reinvestment of income and capital gains. Actual results may differ from the composite results depending upon the size of the account, investment objectives, guidelines and restrictions, inception of the account and other factors. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product, made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Clinton Investment Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Please consult with an investment professional before making any investment using content or implied content from any investment manager. A copy of our current written disclosure statement discussing our advisory services and fees is available upon request.

The views and opinions expressed are not necessarily those of the distributing firm or any affiliates. Nothing discussed or suggested should be construed as permission to supersede or circumvent your firm’s policies, procedures, rules, and guidelines.